1 SECOND PER EMPLOYEE AUTOMATIC PAYROLL CALCULATION OR 86,400 EMPLOYEES IN 24 HOURS

Yes, HR PAYROLL Modules of Ikonomikal Cloud Accounting ERP calculates payroll automatically at 1 second per employee/head.

The calculation includes all the earnings such as Basic pay, De Minimis, Overtime, Holiday Pay, Allowances... and deductions such as Advances, Withholding Taxes and Contributions (SSS, PHIC, HMDF, Union etc.). The payroll calculation includes the generation of reports such as the payroll worksheet, individual payslip, automatic payroll and accrual accounting entries, etc.. The user can also make manual changes on the calculation. The calculation can be separately done for confidential, regular, contractual and casual employees. A group of employees assigned to customers can also be done.

Setups, documents, transactions and reports can be printed/displayed or downloaded in/from the following

Formats:

1. PDF

2. Excel

3. Word

4. Chart

Sources:

1. Setup Master Files to print in PDF, Excel & Word

2. Document (Non transaction) in PDF, Excel & Word

3. Transaction to print in PDF, Excel & Word

4. Analysis to print in PDF, Excel & Word

5. Business Intelligence (Chart, PDF, Ms Word and Excel)

6. Scheduled Automatic Report Generation and Emailing to User/s in PDF, Excel & Word

7. Export to Excel in Setup Master Files and Transactions

8. Email blast of Pay Slips or Statement of Accounts

Example of reports in Excel format from the Business Intelligence program are

1. TX-PHL-1601C – Monthly Remittance Return of Income Taxes Withheld on Compensation

2. TX-PHL-1604CF – Annual Information Return of Inc Tax Withheld on Compensation and Final Withholding

3. TX-PHL-1604CF-ALPHALIST – Alpha List

4. TX-PHL-2316 – Certificate of Compensation Payment Tax Withheld For Compensation Payment With or Without Tax Withheld

Just click excel icon to download the corresponding filled tax forms. More tax forms are being developed. There are also Annualization programs, see below in group of programs:

no.3 line 12 HR Tax Annualization Entry

no.9 line 4 HR Tax Annualization Batch Run

All the programs of HR Payroll Modules are integrated with the other programs of Ikonomikal Cloud Accounting ERP.

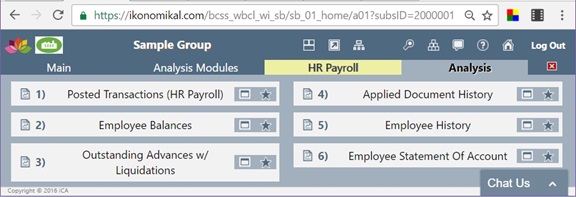

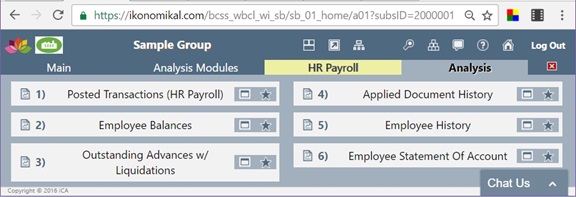

The HR PAYROLL Modules:

1. Core

2. Analysis

HR PAYROLL other reporting program is the Business Intelligence (B.i.) as shown in the above image.

A. HR Payroll Core Modules

Example of printing Document (Non Transaction)

Print mode: Display on screen

Print format: PDF

Document: HR Payment Request

Print mode: Download

Print format: Excel

Document: HR Payment Request

Print mode: Download

Print format: Word

Document: HR Payment Request

HR Payroll Entry Reports

1. Payroll Shipping Point Allowance

2. P.W. Register (By Employee)

3. P.W. Register (By Department)

4. P.W. Register (By Cost Center)

5. Payroll Worksheet by Branch/Class/Dept (All)

6. Payroll Worksheet by Branch/Class/Dept (Taxable)

7. Payslip (Taxable)

8. Payslip (All)

9. P.W. Accounting Entries (By Department)

10. P.W. Accounting Entries (By Cost Center)

11. P.W. Accounting Entries (By Employee).... see sample below

12. Payroll Worksheet By Branch (All)

13. Payroll Worksheet By Branch (Taxable)

14. Payroll Worksheet By Department (All)

15. Payroll Worksheet By Department (Taxable)

16. Payroll Worksheet By Classification (All)

17. Payroll Worksheet By Classification (Taxable)

18. SSS Remittances Summary

19. SSS Remittances Details

20. HMDF Remittances Summary

21. HMDF Remittances Details

22. PHIC Remittances Summary

23. PHIC Remittances Details

24. Withholding Tax Summary

25. Withholding Tax By Classification

26. Withholding Tax Details

Example of printing Transactions

Program: HR Payroll

Print mode: Display on screen

Print format: PDF

Document: Accounting Entries By Employees

Program: HR Payroll

Print mode: Download

Print format: Excel

Document: Accounting Entries

Program: HR Payroll

Print mode: Download

Print format: Word

Document: Accounting Entries

2. HR Payroll Batch Copy

3. HR Time Card Batch Run

4. HR Tax Annualization Batch Run

Example of reports in Excel format from the Business Intelligence program are

1. TX-PHL-1601C – Monthly Remittance Return of Income Taxes Withheld on Compensation

2. TX-PHL-1604CF – Annual Information Return of Inc Tax Withheld on Compensation and Final Withholding

3. TX-PHL-1604CF-ALPHALIST – Alpha List

4. TX-PHL-2316 – Certificate of Compensation Payment Tax Withheld For Compensation Payment With or Without Tax Withheld

|

| Business Intelligence (B.I.)- Tax forms in Excel Format |

no.3 line 12 HR Tax Annualization Entry

no.9 line 4 HR Tax Annualization Batch Run

All the programs of HR Payroll Modules are integrated with the other programs of Ikonomikal Cloud Accounting ERP.

1. Core

2. Analysis

HR PAYROLL other reporting program is the Business Intelligence (B.i.) as shown in the above image.

A. HR Payroll Core Modules

- General Setup

- Documents (Non Transaction)

- Transactions

- Employees And Contracts

- Time Keeping

- Cash Fund Reversals

- Bank Reversals

- Business Intelligence Settings

- Options And Helpers

A. HR Payroll Core Modules

A1. General Setup

- HR Settings

- Religion

- Relationships

A2. Documents (Non Transaction)

- HR Termination Request

- HR Vacation Request/Return

- HR Payment Request

- HR Leave/Advance Request

- HR Liquidation Request

- HR Leave Schedules

Example of printing Document (Non Transaction)

Print mode: Display on screen

Print format: PDF

Document: HR Payment Request

Print mode: Download

Print format: Excel

Document: HR Payment Request

Print mode: Download

Print format: Word

Document: HR Payment Request

A3. Transactions

- HR Payroll

- Employee Advances/Loans

- HR Bank Payments

- HR Cash Payments

- HR Bank Group Payments

- HR Cash Group Payments

- HR Vacations

- HR Terminations

- Liquidation/Refund of Advances

- HR Adjustments

- HR Project Allocations

- HR Tax Annualization Entry

HR Payroll Entry Reports

1. Payroll Shipping Point Allowance

2. P.W. Register (By Employee)

3. P.W. Register (By Department)

4. P.W. Register (By Cost Center)

5. Payroll Worksheet by Branch/Class/Dept (All)

6. Payroll Worksheet by Branch/Class/Dept (Taxable)

7. Payslip (Taxable)

8. Payslip (All)

9. P.W. Accounting Entries (By Department)

10. P.W. Accounting Entries (By Cost Center)

11. P.W. Accounting Entries (By Employee).... see sample below

12. Payroll Worksheet By Branch (All)

13. Payroll Worksheet By Branch (Taxable)

14. Payroll Worksheet By Department (All)

15. Payroll Worksheet By Department (Taxable)

16. Payroll Worksheet By Classification (All)

17. Payroll Worksheet By Classification (Taxable)

18. SSS Remittances Summary

19. SSS Remittances Details

20. HMDF Remittances Summary

21. HMDF Remittances Details

22. PHIC Remittances Summary

23. PHIC Remittances Details

24. Withholding Tax Summary

25. Withholding Tax By Classification

26. Withholding Tax Details

Example of printing Transactions

Program: HR Payroll

Print mode: Display on screen

Print format: PDF

Document: Accounting Entries By Employees

Program: HR Payroll

Print mode: Download

Print format: Excel

Document: Accounting Entries

Program: HR Payroll

Print mode: Download

Print format: Word

Document: Accounting Entries

A4. Employees And Contracts

- HR Branch Settings

- Civil Status

- Job Descriptions

- Employee Profile

- Employee Remit- To/Addresses

- Earnings Profile

- Deductions Profile

- Accruals Profile

- Compensations Profile

- Salary Templates

- Employee Salary

- HR Contract

A5. Time Keeping

- Late Penalty

- Absent Penalty

- Time Schedules

- Time Sets

- Time Set Groups

- HR Job Categories

- HR Time Card Events

- HR Event Calendar

- HR Time Card

A6. Cash Fund Reversals

- HR Cash Payments Reversal

- HR Cash Group Payments Reversal

A7. Bank Reversals

A8. Business Intelligence Settings

1. HR Payroll B.I. TagsA9. Options and Helpers

1. HR Payroll Batch Run2. HR Payroll Batch Copy

3. HR Time Card Batch Run

4. HR Tax Annualization Batch Run

B. HR Payroll Analysis Modules

1. Posted Transactions (HR Payroll)*

2. Employee Balances

3. Outstanding Advances w/ Liquidation*

4. Applied Document History*

5. Employee History*

6. Employee Statement of Account

* = With single and the same name of report, those without * are with list of reports below (B2 & B6)

B2. Employee Balances

1. HR Open Document Balances

2. Employee Accrual Balances (per Item)

3. Employee Accrual Balances (per employee)

4. HR/GL Accrual Balance Reconciliation

HR Open Document Balances

B6. Employee Statement of Account

1. Employee SOA Open Item

2. Employee SOA Balance Forwarded

Employee SOA Balance Forwarded

Please click also the following to know more about Ikonomikal

1. What is Ikonomikal?

2. What are the Security Features of Ikonomikal?

3. Ikonomikal Programming Language and Environment Diagram

4. How Robust is Ikonomikal?

5. Is 3rd Party Interface Possible in Ikonomikal?

6. Company website of Ikonomikal

7. Ikonomikal software site

8. How to Subscribe to Ikonomikal?

2. What are the Security Features of Ikonomikal?

3. Ikonomikal Programming Language and Environment Diagram

4. How Robust is Ikonomikal?

5. Is 3rd Party Interface Possible in Ikonomikal?

6. Company website of Ikonomikal

7. Ikonomikal software site

8. How to Subscribe to Ikonomikal?

9. Cost Savings in Using Ikonomikal

10. Improved Business Model in Using Ikonomikal

11. Return on Investment in Using Ikonomikal

12. Major Features of Ikonomikal

10. Improved Business Model in Using Ikonomikal

11. Return on Investment in Using Ikonomikal

12. Major Features of Ikonomikal

14. New Reduced Monthly Price List or click the Price Startup Packages

Suggested modifications, customizations and developments with general industry use will be done and corresponding upgrades will be deployed accordingly for a fee.

Click to email:Teodoro Rolluqui

No comments:

Post a Comment